Find a Medicare Part D prescription drug plan

Medicare Part D

Prescription Drug Coverage 2026

Medicare Part D Deductibles for 2026

Key Takeaways

- The Medicare Part D deductible might increase to approximately $615

in 2026 , which may affect initial out-of-pocket costs for beneficiaries.

- Beneficiaries may choose between standard plans with the full deductible and enhanced plans with potentially lower or no deductibles to help manage costs more effectively.

- Potential initiatives such as the Selected Drug Subsidy Program and negotiated drug prices could potentially reduce some out-of-pocket expenses for Medicare recipients.

Understanding the 2026 Medicare Part D Deductible

As we venture into

This potential deductible likely to represent the threshold that beneficiaries should meet before their Medicare Part D plan starts to contribute towards their prescription drug expenses. Once this amount has been paid, beneficiaries transition into the Initial Coverage phase, unlocking access to a range of covered medications.

Comprehending the deductible could be crucial for managing finances effectively. This costs will likely determine initial out-of-pocket spending and might impact overall prescription drug costs.

Standard vs. Enhanced Plan Deductibles

When choosing between standard and enhanced Medicare Part D plans, the difference in deductibles may be a significant consideration. Standard plans might come with the full deductible, which must be met before the plan begins to cover medication costs.

Enhanced plans, on the other hand, may feature lower deductibles, possibly offering immediate relief on prescription drug expenses.

Enhanced plans may be particularly appealing, especially those with higher medication needs. Certain plans may also come with higher premiums, but the lower deductible may result in overall cost savings and more predictable out-of-pocket expenses, including Medicare Advantage options.

Comparing these options closely could help in selecting the plan that aligns best with your health and financial requirements to minimize potential risks.

Strategies to Minimize Deductible Costs

Beneficiaries could potentially mitigate the Medicare Part D deductible by choosing plans with lower deductibles. Some plans may have higher premiums but might reduce out-of-pocket costs. This approach could be especially advantageous for those on fixed incomes, likely facilitating better budget management throughout the year.

Utilizing preventive services covered without meeting the deductible may be another effective tactic.

These services could help maintain overall health and potentially reduce the need for more expensive treatments later. Understanding the various nuances of cost-sharing during various coverage phases could aid in more effective expense planning.

Lastly, staying informed about new programs and potential changes, such as the revised simplified determination methodology for creditable coverage, could provide additional avenues to manage costs. Proactive and informed beneficiaries may navigate Medicare Part D complexities with confidence.

Initial Coverage Phase: What Happens After Meeting the Deductible

Once the Medicare Part D deductible has been met, beneficiaries enter the Initial Coverage phase. This phase dictates how much beneficiaries may need to pay for their medications until they reach the next threshold.

In this phase, Medicare Part D plans will likely cover a portion of the drug costs while beneficiaries pay a coinsurance rate of about 25% for covered medications.

Understanding this phase could be vital for managing prescription drug expenses, as it will likely lay the groundwork for subsequent cost-sharing dynamics.

Cost-Sharing During Initial Coverage

During the Initial Coverage phase, cost-sharing may be a crucial component. Beneficiaries may be required to pay up to 25% of the drug costs, while Medicare sponsors may cover approximately 65%.

This arrangement could potentially reduce the overall financial burden on beneficiaries, possibly making essential medications more affordable.

Utilizing preventive services that bypass the deductible might further manage overall health care costs and potentially reduce future expenses. This cost-sharing structure will likely be designed to provide a balance between out-of-pocket costs and coverage, possibly ensuring that beneficiaries could access necessary medications without excessive financial strain.

Possible Impact on Prescription Drug Expenses

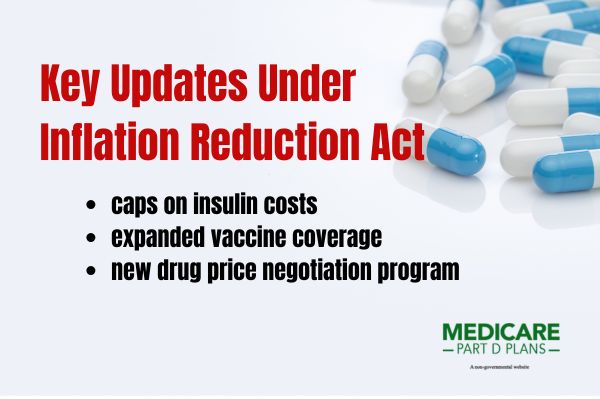

The implementation of negotiated prices for selected drugs could potentially have a significant impact on prescription drug expenses. Negotiated prices might reduce overall out-of-pocket costs for beneficiaries, especially during the initial coverage phase.

Beneficiaries could potentially benefit from reduced financial liability as the negotiated prices may decrease the cost of certain medications, due to the Inflation Reduction Act. This potential drug benefit could be especially important for those on a fixed income, as it may make essential medications more accessible and affordable.

Enhanced plans with lower deductibles may provide further savings on participants prescription drug expenses. These plans, combined with the negotiated prices, could potentially provide a comprehensive approach to managing drug costs effectively, including prescription drug coverage.

Catastrophic Coverage: Protection Against High Costs

Catastrophic Coverage will likely be a critical phase designed to protect beneficiaries from exorbitant drug costs. Once beneficiaries reach the out-of-pocket threshold of about $2,100, they enter this phase and may be no longer required to pay for covered medications for the remainder of the year.

This phase could help protect against high drug costs, possibly preventing them from becoming a financial burden.

The transition into Catastrophic Coverage might mark a significant relief for beneficiaries, as it could potentially offer lower cost coverage for essential medications. Comprehending this phase may be essential for long-term financial planning and health management.

Out-of-Pocket Threshold Increase

The Initial Coverage phase likely continues until beneficiaries’ total out-of-pocket expenses reach this threshold.

These adjustments may be significant, highlighting the evolving nature of Medicare Part D and its efforts to keep pace with the healthcare landscape. Beneficiaries must be aware of these potential changes to plan their expenses effectively and potentially avoid unexpected financial burdens.

Zero-Cost Covered Medications

Reaching the Catastrophic Coverage phase might mean beneficiaries could potentially pay $0 for covered medications for the rest of the plan year. This phase may reduce financial burdens by exempting beneficiaries from certain costs associated with some prescription drugs.

Zero-cost coverage might act as a vital safety net, possibly ensuring access to necessary medications. It will likely underscore the importance of understanding the different phases of Medicare Part D and planning accordingly.

Revised Simplified Determination Methodology for Creditable Coverage

The revised simplified determination methodology for creditable coverage

This simplified determination method may require that coverage provides reasonable access to both brand name and generic medications.

This potential change may make it easier for beneficiaries to determine if their plan is creditable, possibly ensuring they receive the best possible coverage. Grasping this revised methodology may be crucial for beneficiaries and those managing group health plans.

Possible Implications for Group Health Plans

Group health plans should adjust to meet the new creditable coverage standards and determine their plan’s creditable coverage status. Some plans may use either current or revised methodologies to determine their status.

This potential change might increase the threshold from about 60% to 72% of participants’ drug expenses to be considered creditable.

This higher threshold likely reflects the potential benefits under the IRA and group health plans may need to inform Medicare-eligible participants about their coverage’s status.

These potential changes could help ensure beneficiaries receive comprehensive coverage aligned with their healthcare needs.

Employer Considerations

Employers should consider various factors to comply with updated creditable coverage requirements. The revised methodology will likely aim to streamline compliance and evaluation processes, possibly making it easier for employers to adjust their plan designs.

Staying informed and proactive will likely be essential for employers to ensure their plans meet updated creditable coverage requirements and could offer the best benefits to employees.

Selected Drug Subsidy Program

The Selected Drug Subsidy Program could potentially reduce the financial burden on beneficiaries by providing government subsidies for specific drugs, such as the retiree drug subsidy. The program may reduce certain costs for beneficiaries, possibly making essential medications more affordable.

Part D sponsors should include selected drugs on their formularies, possibly ensuring that beneficiaries could have access to these subsidized medications, which may include covered Part D drug options and Part D drugs.

This Part D program likely represents a step towards making prescription drugs more accessible and affordable for all Medicare beneficiaries.

Government Subsidy Details

Under the Selected Drug Subsidy Program, the government may provide a subsidy equal to about 10% of the negotiated price of certain drugs. The subsidy could potentially reduce some out-of-pocket expenses, possibly enhancing medication affordability.

This potential financial relief could be particularly beneficial during the initial coverage phase, where cost-sharing dynamics will likely play a crucial role. Covering a percentage of negotiated drug prices, the government subsidy and reinsurance subsidy might make drug coverage more accessible.

Potential Impact on Negotiated Prices

The Selected Drug Subsidy Program may lower certain drugs costs for Medicare Part D participants. These negotiated prices will likely play a crucial role in determining overall drug costs, possibly making essential medications more affordable.

By potentially leveraging negotiated prices, the manufacturer discount program may be able to improve medication access and potentially reduce financial burdens on beneficiaries. This approach could potentially ensure that participants could manage their prescription drug expenses more effectively and affordably.

See plans in your area instantly!

Advertisement

Medicare Prescription Payment Plan: Automatic Renewals

The Medicare Prescription Payment Plan may include an automatic renewal feature, which may help ensure continuous coverage for beneficiaries unless they choose to opt out. This feature might simplify the process.

Automatic renewals will likely maintain beneficiaries’ current Medicare coverage without requiring action during the Annual Enrollment Period. This convenience could help prevent gaps in coverage and potentially ensure consistent access to necessary medications.

Various Benefits of Automatic Renewal

The automatic renewal feature might offer several benefits, which may include simplifying the enrollment process and coverage for beneficiaries. This hassle-free approach may help reduce the stress of having to choose or re-enroll each year, providing peace of mind.

Automatic renewals may also help avoid potential coverage gaps, medication adherence and overall health outcomes.

This continuity could be vital for maintaining consistent access to necessary medications and avoid late enrollment penalties.

Opt-Out Process

Beneficiaries may easily opt out of automatic renewals if they wish to change their coverage. This process involves submitting a voluntary termination request, which is processed within 24 hours.

Grasping the opt-out process is crucial for beneficiaries looking to explore different coverage options or make changes to their plans.

Executive Order on Lowering Drug Prices

The Executive Order on Lowering Drug Prices will likely emphasize:

- The need for the Medicare Drug Price Negotiation Program to improve cost transparency

- A focus on high-cost drugs

- Stabilizing Medicare Part D premiums

One of the potential initiatives under this order might be the Selected Drug Subsidy Program, which could potentially enable Medicare to negotiate drug prices directly with manufacturers, possibly reducing costs for beneficiaries.

This program may be able to lower some drug prices, likely leveraging negotiated prices to make medications more affordable.

The government may also provide a subsidy amounting to about 10% of the negotiated drug price to Part D sponsors under this program.

Additionally, the order might include plans for a payment model that could potentially enhance the Medicare program’s ability to negotiate better prices for high-cost medications.

Find a Plan and Enroll Online Yourself!

Advertisement

Summary

As we navigate the potential changes to Medicare Part D

The potential increase in the annual deductible might mark a slight rise from previous years, but with understanding and strategic planning, this can be managed effectively.

Beneficiaries should explore different plan options, take advantage of plans that may offer lower deductibles, and utilize preventive services to help minimize out-of-pocket costs. The potential introduction of the Selected Drug Subsidy Program and simplified determination methodology for creditable coverage could potentially make drugs more affordable and coverage more comprehensive.

By staying proactive and informed, beneficiaries can navigate these possible changes smoothly and ensure they receive the best possible care and financial protection.

Frequently Asked Questions

What is the Medicare Part D deductible for 2026 ?

The Medicare Part D deductible

How does the Initial Coverage phase work after meeting the deductible?

Once you’ve met the deductible, you may pay about 25% of the costs for covered medications during the Initial Coverage phase, while Medicare covers approximately 65%. This phase could potentially reduce your out-of-pocket expenses for prescription drugs.

What is the Catastrophic Coverage phase?

The Catastrophic Coverage phase occurs when a beneficiary’s out-of-pocket expenses hit about $2,100, possibly allowing them to pay $0 for covered medications for the rest of the year.

This phase could provide important financial relief for those facing high healthcare costs.

How could I minimize my out-of-pocket costs under Medicare Part D?

To minimize your out-of-pocket costs under Medicare Part D, members should select plans that may offer lower deductibles and stay informed about cost-sharing options and available programs, such as the Selected Drug Subsidy Program. This proactive approach could help you manage your expenses effectively.

What is the Selected Drug Subsidy Program?

The Selected Drug Subsidy Program offers about 10% government subsidy on the negotiated price of specific drugs, which could potentially reduce out-of-pocket expenses for beneficiaries starting

This initiative will likely be designed to enhance affordability and access to necessary medication

Begin Choosing your plan

Advertisement

ZRN Health & Financial Services, LLC, a Texas limited liability company.