Find a Medicare Part D prescription drug plan

Medicare Part D

Prescription Drug Coverage 2026

AARP Medicare Part D Plans

AARP Medicare Part D plans could help seniors manage prescription drug costs effectively. This article will explore the potential benefits, available plan types, possible costs, and how to choose the right plan for your needs.

Key Takeaways

- AARP Medicare Part D plans will likely offer affordable prescription drug coverage and access to a wide pharmacy network, likely aiming to help reduce medication costs for seniors.

- The plans will likely include two main types: standalone PDPs for drug coverage alone, and Medicare Advantage plans that might incorporate both health and drug benefits.

- Potential changes, such as an approximate $2,000 out-of-pocket maximum and the possible elimination of the coverage gap may help simplify costs and enhance affordability for members.

Overview of AARP Medicare Part D Plans

AARP Medicare Part D plans will likely be designed with seniors in mind, likely offering Medicare Part D prescription drug coverage that could help manage medication expenses efficiently. These plans may be popular among older adults due to their potential for significant cost savings and the financial protection they could provide.

One of the potential advantages of these plans might be their affordability. Potential benefits of AARP Medicare Part D plans might include:

- Lower copays for medications compared to traditional Medicare

- Access to a wide network of pharmacies, possibly ensuring convenient and economical prescription filling

- Coverage for vaccines

The possibility of having lower prescription drug costs could make these plans an attractive option for seniors looking to manage their medication expenses effectively. Comprehensive drug coverage through AARP Medicare Part D plans could significantly contribute to the health and well-being of older adults.

Types of AARP Medicare Part D Plans

AARP will likely offer two main types of Medicare Part D plans that could cater to different needs: standalone prescription drug plans (PDPs) and Medicare Advantage plans that may include prescription drug coverage.

Standalone PDPs will likely focus solely on prescription drug coverage, possibly making them a suitable choice for individuals who already have health insurance coverage through Original Medicare or a Medigap plan.

On the other hand, some Medicare Advantage plans may combine health care and prescription drug coverage, possibly providing a more integrated approach to health insurance coverage.

Potential Features of AARP Medicare Rx Preferred Plan

The AARP Medicare Rx Preferred plan might stand out for its extensive drug coverage and broad pharmacy network. This plan will likely cover a comprehensive formulary, possibly ensuring that a wide range of medications may be accessible to its members.

One of the potential advantages of the AARP Medicare Rx Preferred plan might be the elimination of the annual prescription deductible, which could mean members may start saving on their medications right away. Additionally, copays for preferred generic drugs at a preferred pharmacy may be as low as $5 for a 30-day supply, possibly making it an economical choice for many seniors.

For specialty drugs, the cost share will likely be about 33% of the drug’s price at both preferred and standard pharmacies, possibly ensuring that even high-cost medications may be more affordable. These potential features could make the AARP Medicare Rx Preferred plan a robust option for comprehensive prescription drug coverage.

Costs Associated with AARP Medicare Part D Plans

Understanding the potential costs associated with AARP Medicare Part D plans will likely be crucial for managing your healthcare budget effectively. Some plans may involve various expenses, such as:

- premiums

- deductibles

- copayments

- coinsurance

The monthly premium will likely act as the fee for enrollment in a Part D plan, and higher premiums could correlate with better coverage. Other major cost components might include:

- Annual deductible: The predetermined amount that must be paid out-of-pocket before coverage begins; changes to these costs may arise periodically.

- Copayments: Fixed fees paid for each prescription, which might vary based on the drug tier classification.

- Coinsurance: Requires the patient to pay a percentage of the drug cost, which may differ between plans.

Individuals with limited income could potentially benefit from the Extra Help program, which may help reduce certain Medicare Part D costs, such as deductibles and copays. Eligibility for this program will likely be determined based on the individual’s income and resources, possibly making it a valuable resource for those who qualify.

How to Choose the Right AARP Medicare Part D Plan

Choosing the right AARP Medicare Part D plan will likely require careful consideration of your medication needs. Prioritize coverage for your medications to help minimize out-of-pocket expenses. Utilizing the Plan Finder Tool on this website to help assess which plans might include your prescriptions in their formularies.

Additionally, evaluate if your preferred pharmacies may be part of the plan’s network, as this could potentially affect the cost of your medications. By comparing different plans based on premiums, deductibles, and medication costs, you could potentially save money and select the best plan for your situation.

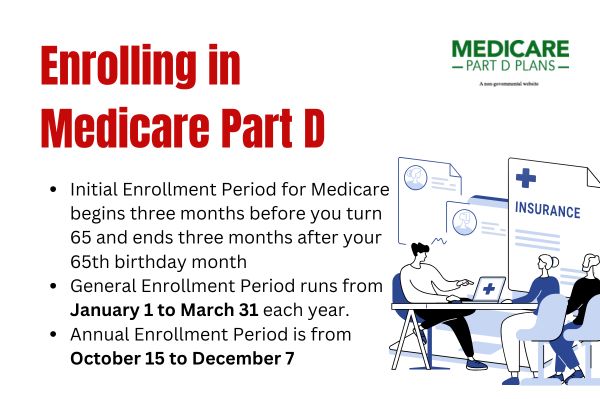

Enrollment Process for AARP Medicare Part D Plans

Enrolling in an AARP Medicare Part D plan is a straightforward process, with the open enrollment period running from October 15 to December 7 each year. During this time, you can switch your Medicare Part D plan to better meet your needs.

Special circumstances, such as moving out of a nursing home or if your current plan is no longer contracted with Medicare, allow you to join or switch Part D plans outside the open enrollment period. Eligibility for AARP Medicare Part D plans typically requires individuals to be enrolled in Medicare Part A and/or Part B.

AARP provides support through the State Health Insurance Assistance Program (SHIP) for AARP members needing assistance with the enrollment process. This program provides personalized guidance to help you navigate the complexities of Medicare enrollment.

To enroll, call one of our licensed agents at 1-866-930-4039 (TTY 711) Mon-Fri: 8am-8pm EST.

Possible Changes to AARP Medicare Part D Plans in 2026

The year 2026 might bring several changes to AARP Medicare Part D plans due to the Inflation Reduction Act. One of the potential changes might be the introduction of an approximate $2,000 out-of-pocket maximum, which could help cap annual medication expenses for enrollees.

Additionally, the possible elimination of the coverage gap, commonly known as the ‘donut hole,’ might mean beneficiaries may experience consistent cost-sharing throughout the year.

These potential changes will likely be designed to simplify the initial coverage stage and potentially reduce certain out-of-pocket costs for prescription drugs, possibly leading to more coverage, catastrophic coverage, and predictable expenses for members.

Potential Benefits of Using a Preferred Network Pharmacy

Using a preferred network pharmacy could offer numerous benefits, such as:

- Lower copayments for prescriptions compared to non-network options.

- Agreements with insurance providers, which may offer discounted medication prices.

Preferred network pharmacies will likely be conveniently located within communities, possibly providing easier access to medications.

For those managing diabetes, preferred network pharmacies may also offer insulin with a copay of about $35, possibly making essential medications more affordable. Utilizing a preferred network pharmacy may also help reduce certain prescription drug costs and enhance your overall healthcare experience.

Possible Restrictions and Limitations

AARP Medicare Part D plans might impose formulary restrictions that could limit coverage for certain brand-name medications, which might require enrollees to verify if their prescribed drugs are included in the plan’s formulary of covered drugs. For instance:

- Formulary restrictions might limit coverage for certain medications.

- Enrollees must verify if their prescribed drugs are on the plan’s list of covered medications.

- Prior authorization may be required for some medications.

- Patients may need to obtain approval from their plan before the medication is covered.

Additionally, not all plans may utilize step therapy protocols, which might mandate that patients try less expensive options before being approved for more costly medications. Quantity limits may also be imposed on certain drugs, possibly capping the amount covered over a defined period to enhance safety and control costs.

Financial Assistance Programs

The Extra Help program will likely be designed to aid low-income individuals in managing their prescription drug costs under Medicare Part D. This program could potentially reduce the costs of some premiums, deductibles, and copayments for those who qualify, possibly making it a valuable resource for eligible individuals.

Recipients of financial assistance through the Extra Help program could have the flexibility to change Part D plans quarterly during the first three quarters of the year. This option may allow beneficiaries to adjust their coverage as needed to better manage their medication expenses.

See plans in your area instantly!

Advertisement

How to Switch AARP Medicare Part D Plans

Switching AARP Medicare Part D plans is straightforward during the annual enrollment period, which allows members to find better coverage or lower costs. It is essential to carefully compare your current plan with new options available to ensure they meet your prescription needs.

For instance, the Medicare Prescription Payment Plan may allow members to spread their out-of-pocket prescription costs into monthly payments over the year, possibly helping to pay the burden of high medication costs. This program could provide financial flexibility and may ease the burden of high medication costs.

Tips for Maximizing Your AARP Medicare Part D Benefits

Maximizing your AARP Medicare Part D benefits might involve taking advantage of available resources and programs. Some plans may offer one-time transition fills for medications that might not be covered or require prior authorization, possibly allowing for immediate access while navigating Medicare benefits coverage.

Additionally, participating in Medication Therapy Management (MTM) programs may help individuals with complex health needs optimize their drug therapies. Utilizing these programs could potentially ensure you get the most out of your Medicare Part D coverage.

Find a Plan and Enroll Online Yourself!

Advertisement

Summary

AARP Medicare Part D plans will likely offer comprehensive prescription drug coverage that could potentially reduce some medication expenses for seniors. By understanding the different types of plans, possible features, costs, and enrollment processes, you can make informed decisions about your healthcare.

The potential changes for 2026 may further enhance the value of these plans, possibly making them an even more attractive option for managing your prescription drug costs effectively. Choose wisely and take full advantage of the benefits available to you.

Frequently Asked Questions

What are the main types of AARP Medicare Part D plans?

AARP will likely offer standalone prescription drug plans (PDPs) and Medicare Advantage plans that might incorporate prescription drug coverage. It’s essential to evaluate these options based on your specific medication needs and budget.

What is the out-of-pocket maximum for AARP Medicare Part D plans in 2026?

The out-of-pocket maximum for AARP Medicare Part D plans in 2026 may be set at around $2,000. This potential cap could help protect beneficiaries from high prescription drug costs.

How could I reduce my prescription drug costs with AARP Medicare Part D plans?

Members may be able to reduce their prescription drug costs with AARP Medicare Part D plans by using a preferred network pharmacy, which may lead to lower copayments and discounted medication prices. This simple step could potentially make a difference in your out-of-pocket expenses.

What financial assistance may be available for low-income individuals?

Low-income individuals could potentially benefit from the Extra Help program, which may lower certain costs for Medicare Part D, such as premiums, deductibles, and copayments. This assistance could make certain prescription medications more affordable.

When can I switch my AARP Medicare Part D plan?

You can switch your AARP Medicare Part D plan during the annual enrollment period from October 15 to December 7, or if you qualify for special circumstances like moving out of a nursing home. Be sure to check your eligibility to make the most of your coverage options.

Begin Choosing your plan

Advertisement

ZRN Health & Financial Services, LLC, a Texas limited liability company.