Find a Medicare Part D prescription drug plan

Medicare Part D

Prescription Drug Coverage 2026

Does Medicare Part D Cover Ozempic?

If you’re wondering if Medicare Part D covers Ozempic, the short answer is yes, but with specific conditions. This article will guide you through what those conditions are, from formulary inclusion to FDA-approved uses, ensuring you understand all the requirements and options available for coverage.

Key Takeaways

- Medicare Part D will likely cover Ozempic for Type 2 diabetes management if prescribed for FDA-approved uses and included in the plan’s formulary.

- Ozempic may not be covered by Medicare if prescribed solely for weight loss; alternative medications like Wegovy may be applicable for weight management.

- Financial assistance programs and potential legislative changes may offer support towards medication costs under Medicare, likely promoting accessibility for eligible patients.

Medicare Part D and Ozempic: What You Need to Know

Medicare Part D will likely be designed to cover prescription drugs and treatments, possibly ensuring that enrollees have access to necessary medications. However, the question often arises: does Medicare cover Ozempic?

The answer is yes, but with specific stipulations. For Ozempic to be covered, it must be included in the plan’s formulary and prescribed for FDA-approved uses like diabetes management. Additionally, Medicare covers Ozempic when it meets these criteria.

Enrollees should review their Medicare plan’s formulary to see if Ozempic is covered and understand prior authorization requirements. Your healthcare provider could provide valuable guidance in navigating the specifics of your Medicare coverage related to Ozempic.

Comprehending Medicare Part D plans and their coverage options could significantly impact your health management. Ensure your prescribed medication aligns with the plan’s formulary and FDA-approved indications to help maximize your FDA approval benefits.

Coverage for Type 2 Diabetes

When it comes to managing Type 2 diabetes, Medicare Part D will likely cover Ozempic, provided it is prescribed specifically for this purpose. This means that if your doctor prescribes Ozempic to help control your blood sugar levels, it will likely fall under Medicare’s prescription drug coverage.

Ozempic is FDA-approved for managing Type 2 diabetes and may also reduce cardiovascular disease complications and heart disease. This dual benefit of managing blood sugar and potentially reducing the risk of cardiovascular events could make it a valuable medication for patients.

However, for Ozempic to be covered, it must be prescribed for its FDA-approved use of managing Type 2 diabetes. This likely highlights the necessity of a doctor’s prescribe and ensuring the medication may be included in your Medicare plan’s formulary. Collaborating with your healthcare provider could potentially ensure your treatment aligns with Medicare’s coverage criteria.

Exclusions for Weight Loss

Medicare Part D explicitly prohibits coverage for drugs intended solely for weight loss. This means that if Ozempic was prescribed solely for weight management, it may not be covered under Medicare Part D. Understanding this exclusion will likely be crucial for patients who might be considering Ozempic for weight loss purposes.

Interestingly, Wegovy, another GLP-1 medication, may be approved for weight management. This difference in approved indications means that while Ozempic may not be covered for weight loss, Wegovy might be, depending on your Medicare plan.

The effectiveness of weight loss could also vary between these medications. Clinical trials have shown that Wegovy may have greater results in weight loss compared to Ozempic. Therefore, if weight management is your primary goal, discussing these options with your healthcare provider may be essential to find the most suitable and covered weight loss drugs medication.

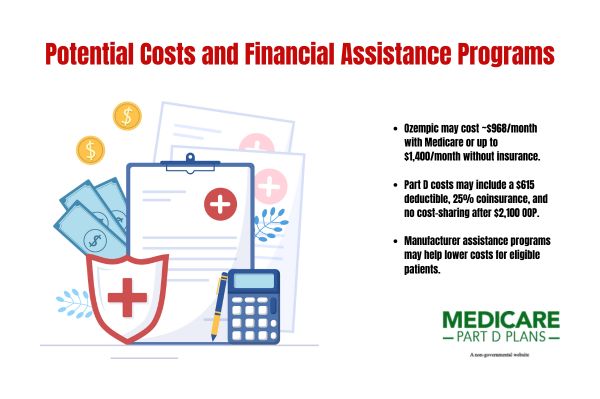

Potential Costs and Financial Assistance Programs

The cost of Ozempic may be a significant concern for many patients. Under Medicare, the average cost of Ozempic may be around $968.52 per monthly injection, but without insurance, the cost could range between $1,000 to $1,400 a month. Several factors, such as benefits, deductibles, and coverage gaps, may influence these costs.

The cost-sharing structure for covered Part D drugs may be as follows:

- The annual deductible might be set around $615.

- Enrollees may pay up to 25% coinsurance for covered drugs in the initial coverage phase.

- Once an enrollee reaches the annual out-of-pocket spending threshold of about $2,100, they might not pay cost-sharing for covered Part D drugs in the catastrophic phase.

Additionally, the manufacturer of Ozempic may offer patient assistance programs that could potentially provide financial support for eligible patients. If your insurance denies coverage for Ozempic, checking for this assistance programs could offer significant financial relief.

Comparing Ozempic with Other GLP-1 Medications

Ozempic will likely be used for managing blood sugar levels in Type 2 diabetes and obesity. However, other GLP-1 medications like Wegovy, Mounjaro, and Zepbound may have different coverage criteria based on their FDA-approved indications.

Mounjaro, for instance, combines two active ingredients, potentially offering improved blood sugar control compared to Ozempic. Zepbound, another GLP-1 medication, may have a different mechanism of action, affecting its effectiveness for patients compared to Ozempic.

Understanding these differences could help you make informed decisions about your treatment options. By comparing the benefits and drawbacks of each medication, you could work with your healthcare provider to choose the best option for managing your diabetes, weight, and manage blood sugar levels.

See plans in your area instantly!

Advertisement

How to Check if Your Plan Covers Ozempic

To check if your Medicare plan covers Ozempic, you can start by using this website or calling one of our licensed agents using the number on this website. These resources can provide clarity on whether Ozempic might be included in your plan’s formulary and any necessary prior authorization requirements.

Obtaining pre-authorization by demonstrating medical necessity through documented health conditions could potentially improve the chances of getting Ozempic covered. Consulting with a healthcare provider may also help navigate these requirements and identify whether medically accepted weight loss medications are suitable for you.

Taking these steps will likely ensure you are fully informed about your coverage options, possibly allowing you to reduce risk and make the best decisions for your health.

What to Do if Ozempic is Not Covered

If your Medicare plan does not cover Ozempic, don’t lose hope. Certain State Medicaid programs might cover Ozempic, though certain qualifications such as prior authorizations and specific BMI targets may be required. Understanding these requirements and working with your healthcare provider to meet them will likely be necessary.

If Ozempic is not covered, discuss alternative medications and treatment options with your healthcare provider. Other effective off-label medications might be included in your plan’s formulary.

Exploring patient assistance programs that may be offered by the manufacturer of Ozempic could potentially provide financial support if your insurance denies coverage. These programs could be a lifeline for those needing financial assistance to access their medications.

Potential Legislative Changes Impacting Coverage

Potential legislative changes might impact Medicare coverage. For instance, individuals qualifying for Extra Help may pay no more than $4.90 for generic medications and possibly up to $12.15 for brand-name drugs. This potential change might make medications more affordable for those with limited income.

The Medicare Limited Income Newly Eligible Transition (LI NET) Program may also offer temporary Part D drug coverage for individuals qualifying for Extra Help without an active Medicare plan. Additionally, individuals with Medicaid or receiving Extra Help may be able to change their drug coverage monthly.

These potential changes likely highlight the evolving landscape of Medicare coverage. Staying informed about these potential updates could help you navigate your health care options more effectively.

Find a Plan and Enroll Online Yourself!

Advertisement

Summary

Medicare Part D does cover Ozempic when prescribed for managing Type 2 diabetes, provided it is included in the plan’s formulary. While there may be explicit exclusions for weight loss, understanding your coverage options and working closely with your healthcare provider could potentially ensure you receive the necessary treatments.

Navigating the complexities of Medicare coverage might be challenging, but staying informed about your plan’s specifics, potential legislative changes, and available financial assistance programs could make a significant difference. Take proactive steps to understand your coverage and explore all available options for managing your health effectively.

Frequently Asked Questions

Does Medicare Part D cover Ozempic for diabetes management?

Yes, Medicare Part D covers Ozempic for Type 2 diabetes management if it is included in your plan’s formulary. Be sure to check your specific plan details to confirm coverage.

Is Ozempic covered by Medicare for weight loss?

Ozempic is not covered by Medicare for weight loss, as Medicare Part D specifically excludes coverage for medications prescribed solely for this purpose.

What should I do if my Medicare plan does not cover Ozempic?

If your Medicare plan does not cover Ozempic, consult your healthcare provider for alternative medications and explore possible assistance programs from the manufacturer. This proactive approach could help you find a solution that meets your needs.

What possible legislative changes could impact Medicare coverage for prescription drugs?

Potential legislative changes may allow individuals qualifying for Extra Help to experience certain costs reductions for medications, and those with Medicaid or receiving Extra Help may have the flexibility to change their drug coverage on a monthly basis.

Begin Choosing your plan

Advertisement

ZRN Health & Financial Services, LLC, a Texas limited liability company.