Find a Medicare Part D prescription drug plan

Medicare Part D

Prescription Drug Coverage 2026

Late Enrollment Penalty for Medicare Part D in 2026

Curious about the late enrollment penalty for Medicare Part D

Key Takeaways

- The late enrollment penalty for Medicare Part D will likely be a recurring fee incurred for delaying enrollment without creditable coverage, which could impact monthly premiums for as long as coverage is maintained.

- The penalty will likely be calculated as about 1% of the national average premium for each month of delayed enrollment, possibly leading to significant long-term costs if coverage is not maintained.

- To help avoid penalties, individuals should enroll during their initial eligibility period, verify creditable coverage, and stay informed about deadlines and potential changes in regulations.

Understanding the Late Enrollment Penalty for Medicare Part D in 2026

The late enrollment penalty for Medicare Part D

The late enrollment penalty exists for several reasons, such as:

- To encourage timely enrollment and maintain a balanced system for all participants.

- To ensure that people enroll when first eligible, allowing Medicare to better manage overall costs.

- To help keep premiums more stable for everyone.

- To act as a safeguard against adverse selection, where only those needing medication would otherwise enroll, possibly driving up costs. Additionally, late enrollment penalties will likely serve to reinforce these objectives.

Enrolling in a Medicare drug plan when first eligible or having creditable drug coverage could help you avoid the late enrollment penalty. Important points to consider may include:

- Missing the initial enrollment period could lead to accumulating penalties.

- Not having a valid special enrollment period may also result in penalties.

- It’s important to act promptly to avoid these penalties.

How the Late Enrollment Penalty Is Calculated

Understanding how the late enrollment penalty may be calculated could help you grasp the importance of timely enrollment. The penalty will likely be determined as follows:

- Multiply about 1% of the national average Medicare Part D premium by the number of full months a person was eligible but did not enroll.

- For each month without creditable coverage, the penalty increases.

- The penalty may accumulate up to 12% annually.

Consider a scenario where a beneficiary goes without creditable coverage for five years:

- Their penalty could amount to an approximate $22.10 per month on top of their regular premium.

- While this may seem minor initially, it accumulates over time, possibly leading to additional costs.

- This likely underscores the importance of not delaying enrollment, as even short gaps could potentially result in compounded penalties that the enrollee pays.

If there is a gap in coverage lasting 63 days or longer, beneficiaries may face a late enrollment penalty for Medicare drug coverage. This penalty not only applies for those who need medication immediately but may also apply across the board, reinforcing the need for continuous coverage to help avoid unexpected financial burdens.

Avoiding the Late Enrollment Penalty for Medicare Part D in 2026

To avoid the late enrollment penalty, enroll in Medicare Part D during your initial enrollment period, usually around your 65th birthday. Timely enrollment helps you avoid penalties and maintain continuous coverage.

For those who may struggle with the costs of prescription drug coverage, financial assistance programs like the Low-Income Subsidy (LIS) may be available and possibly exempt individuals from the late enrollment penalty.

These programs could potentially provide significant relief and make it easier to stay on top of your Medicare Part D enrollment.

Understanding exemption options and enrolling during the initial period will likely be crucial strategies to help avoid penalties. Staying informed and proactive could help you make the most of your Medicare Part D benefits without facing penalties.

Creditable Coverage and Its Role

Creditable prescription drug coverage may pay, on average, at least as much as Medicare’s prescription drug benefit. This could potentially mean that if you have alternative coverage that meets or exceeds the standard benefit structure set by Medicare, you might not face a late enrollment penalty. Understanding what qualifies as creditable coverage might save you from unnecessary costs.

Coverage from employers, unions, TRICARE, and certain government programs may qualify as creditable coverage.

However, having drug coverage through an employer might not exempt individuals from needing to enroll in Medicare Part D if that coverage is not considered creditable. Verify with your plan whether your coverage meets Medicare’s standards.

To manage your Medicare plan and plan’s creditable coverage status effectively, members should:

- Inform their Medicare plan about existing creditable coverage to potentially avoid penalties.

- Maintain continuous creditable coverage to help prevent penalties and possibly ensure uninterrupted prescription drug coverage.

- Beneficiaries may use either the existing or a revised simplified determination method for assessing creditable coverage determination in certain Medicare Advantage plans.

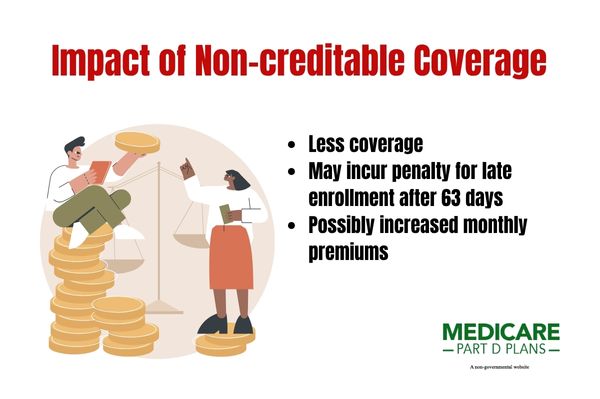

Possible Impact of Non-Creditable Coverage

A prescription drug plan classified as non-creditable may provide less coverage than Medicare’s standard Part D plan. If Medicare-eligible participants enroll in a non-creditable drug plan, they may incur a late enrollment penalty if they fail to enroll in Part D after 63 days.

This penalty might persist for as long as the individual maintains their Medicare prescription drug plans coverage, likely making it crucial to ensure your plan meets the creditable coverage criteria.

Not having creditable coverage could lead to long-term financial consequences and possibly increased monthly premiums for Medicare Part D. Verifying your coverage status and making timely decisions are essential to help avoid penalties and possibly ensure comprehensive brand name drug coverage.

Monthly Penalty Formula Explained

The late enrollment penalty for Medicare Part D

- The penalty rate may be up to 1% per month without creditable coverage.

- For each month an individual delays enrollment in Medicare Part D, a penalty of about 1% of the national base beneficiary premium may be added to their monthly premium.

- The national base premium may change annually, which could affect the overall penalty amount.

The penalty amount will likely be added to your Medicare plan’s premium for as long as you maintain coverage. This ongoing cost likely underscores the financial impact of the late enrollment penalty and the importance of timely enrollment.

Penalty Appeals and Waivers

Individuals may request a review of their late enrollment penalty through a reconsideration process by completing the appropriate form provided by their Medicare Part D plan. This formal process allows beneficiaries to appeal the penalty if they believe it was assessed in error or if there are mitigating circumstances.

The reconsideration of a late enrollment penalty might involve some of the following steps:

- An Independent Review Entity conducts the reconsideration.

- The entity must issue a final decision within 90 days of receiving the appeal request.

- Beneficiaries may appeal a late enrollment penalty by submitting a reconsideration request to the Independent Review Entity.

- This request will likely be made after receiving a notification from their Part D plan.

This process could potentially ensure a maximum fair price and a transparent review of appeals using a revised simplified determination methodology.

Appeals for the late enrollment penalty should be based on specific circumstances outlined in the reconsideration request form provided by the Part D plan and submitted within the indicated timeframe. This structured approach likely ensures efficient handling of appeals.

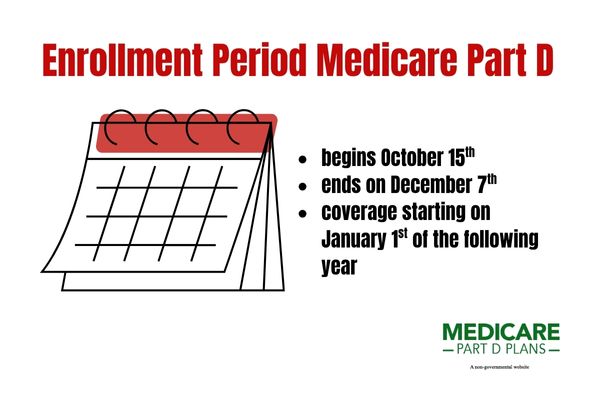

Important Dates and Deadlines

The enrollment period for Medicare Part D typically begins on October 15 and ends on December 7 each year, with coverage starting on January 1 of the following year. This annual open enrollment period is a crucial time to review and make changes to your Medicare coverage.

Missing this window means you’ll have to wait until the next year to enroll unless you qualify for a special enrollment period.

Those who qualify for Medicare after age 65 have a seven-month enrollment window starting three months before their birthday month. Missing the annual open enrollment period means waiting until the next year to enroll, unless they qualify for a special enrollment period.

Staying aware of these important dates and deadlines could help ensure you avoid the late enrollment penalty and maintain a continuous period of coverage.

See plans in your area instantly!

Advertisement

Possible Changes in 2026 Regulations

As

These adjustments could potentially make prescription drug coverage more accessible and affordable.

The annual deductible for Part D

Under the selected drug subsidy program, the Part D program might allow Part D sponsors to receive a government subsidy equating up to 10% of a selected drug’s negotiated price. These potential changes will likely design to help reduce out-of-pocket costs and provide better value for beneficiaries.

The annual out-of-pocket threshold for Medicare Part D

Common Misconceptions About the Late Enrollment Penalty

Enrollment in Medicare is restricted to specific windows and missing these might incur penalties. One common misconception is that individuals must stop contributing to a Health Savings Account (HSA) when they turn 65, but they may continue if not enrolled in any part of Medicare. Understanding these nuances could help you avoid unnecessary penalties and make informed decisions about your healthcare coverage.

Another misconception might be that cancelling coverage after incurring the penalty may eliminate additional charges, but these penalties persist as long as you remain enrolled. Delaying enrollment for an extended period might result in a substantially larger penalty, possibly impacting those on fixed incomes significantly.

It’s crucial to debunk these myths to ensure that beneficiaries are fully aware of the implications of their choices.

Find a Plan and Enroll Online Yourself!

Advertisement

Summary

The late enrollment penalty for Medicare Part D will likely be a significant consideration for anyone approaching their initial enrollment period. Understanding how the penalty might be calculated, the role of creditable coverage, and the potential impact of non-creditable coverage will likely be essential for making informed decisions.

By enrolling on time and staying aware of important dates and deadlines, you could potentially avoid unnecessary costs and ensure continuous coverage.

As the regulations may change

Frequently Asked Questions

What is the annual out-of-pocket (OOP) threshold for CY 2026 ?

The annual out-of-pocket (OOP) threshold for calendar year

What is the value for creditable coverage under the revised methodology for CY 2026 ?

The value for creditable coverage under the revised methodology for CY

What subsidy could Part D sponsors receive for selected drugs under the selected drug subsidy program?

Part D sponsors may receive a government subsidy of up to 10% of the negotiated price for selected drugs under the selected drug subsidy program. This potential assistance might help lower certain costs for medication coverage.

What does the successor regulation exception allow regarding formulary substitutions of selected drugs?

The successor regulation exception may allow Part D sponsors to remove a selected drug from their formularies, provided the removal complies with the guidelines of the successor regulation.

What is the annual deductible for the defined standard benefit in CY 2026 ?

The annual deductible for the defined standard benefit in CY

Begin Choosing your plan

Advertisement

ZRN Health & Financial Services, LLC, a Texas limited liability company.